A Good Choice for MMJ and Biotech Market Opportunity

Gaalen Engen, Stockhouse.com

For almost fifty years, his was a trusted voice when it came to sports and news. Bill Good, following in the footsteps of his father, “Breathless Bill”, established himself as a national broadcasting icon over a long career which included hosting Hockey Night in Canada, anchoring the Vancouver edition of Canada Tonight and co-anchoring CTV Vancouver’s nightly newscast.

When he entered semi-retirement in 2014 after leaving the daily broadcast responsibilities at CKNW, the seasoned TV and radio personality was presented with some opportunities in the world of business where he could apply the same practiced acumen that made him a renowned journalist.

Bill’s son, Derek, an already established entrepreneur within the business community, is co-founder of Vodis Pharmaceuticals (CSE: VP, Forum), a leading brand in the medical and recreational marijuana space, as well as being an early investor in BioMark Diagnostics (CSE: BUX, Forum), an oncology company focused on cutting-edge detection and treatment technologies. Both of which peaked Bill’s interest, so he agreed to sign on in an advisory position under one condition as Good explained, “I agreed as long as it was really clear that I came on board to give advice; to be a supporter and not a promoter. I don’t promote stocks or anything like that.”

“I’m involved with BioMark, because like many people, I have a personal connection to cancer, as my wife went through two bouts with it,

and I believe the opportunity with this company with early detection and the real possibility that it could happen would change peoples’ lives the world over.”

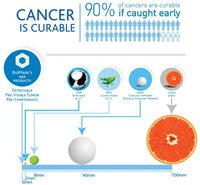

He’s right about the revolutionary aspect to BioMark’s diagnostic offering. The company is working in an exciting relatively new field of metabolomics or the systemic study of the unique chemical footprints that specific cellular processes leave behind.

What this boils down to is the presence of metabolites that active or highly expressive cancer cells shed that can be identified long before the tumour is visible (less than 1 mm) and presents any symptoms. This is an incredibly important diagnostic breakthrough as many cancers are curable if caught early and BioMark’s diagnostic platform is geared to catch it earlier than any other known method.

Good outlined some other advantages to BioMark’s tech, “It would be inexpensive. It would mean that people may not have to go through ugly and invasive procedures like radiation and chemo, and if they did, those providing the treatment would know more directly what it was for.”

Okay, but there are many biotech companies out there with lofty aspirations, however in the end, they have more promise than progress. Bill found BioMark to be different, “I met with the CEO and founder, Rashid Ahmed. In fact, both Georgy and I met with the entire research team in Richmond. It seems very real. They’ve been working for seven or eight years here and around the world with a number of universities and cancer institutes and are in the advanced stage of validating their clinical trials.”

So, you have a radically disruptive tech in the home stretch of Health Canada approval. In a world where cancer is among the leading causes of death across the globe and climbing incidence of new cancer cases expected to reach 22 million by 2032, early detection has become paramount and BioMark’s tech will provide the earliest result. Also the system is economical and easy to use, making it a prime candidate to service massive regional markets that have never before had the opportunity to benefit from early cancer detection like China, India and Africa. I have no trouble predicting that BioMark has the potential to capture a massive share of the global cancer/tumour profiling market expected to be worth $35.03 billion by 2018.

Okay, that explains BioMark, let’s move onto Vodis Pharmaceuticals.

“When it came to Vodis, I was really impressed with the opportunities, both for medicinal and recreational over time.

And this was before Vodis got involved in the American market which I think is brilliant. Knowing that Cannacord was really bullish on the company also really impressed me”

“To me it’s been obvious for a decade that marijuana was going to be legalized and I believe the recreational side which is expanding in the US will come to Canada. Even if it doesn’t, I think there is going to be a whole demographic of people my age, and approaching it, that are looking for alternatives to pharmaceuticals. As such, I think it’s a tremendous growth industry.”

Vodis, like many within the space, has an application for its MMPR with Health Canada and is just awaiting approval. Now there are better than 1000 MMPR applications currently submitted with the regulatory authority and according to the Health Canada website, only 29 of those applications have been given approval. There is a serious bureaucratic bottleneck that doesn’t look like its gong to rectify itself any time soon. Another thing worth mentioning that as of September 30, 2015, there were only 30,000 registered clients – not an incredibly large market until the recreational segment is legalized, whenever that’s going to happen. So in the end, what we have are a swath of me-too MMJ hopefuls sitting idle, financing to just keep the lights on, waiting for a license that may never come to service a currently tiny market.

This is where Vodis really differs from the typical pie-in-the-sky MMPR applicant, and, in my opinion, where it shines like the sun. Using Health Canada’s stringent design and engineering standards, the company is building state-of-the-art facilities in the less bureaucratic American market. It is then leasing them to local licensed growers and providing training and consulting to their tenants under the Vodis brand. All of this generates revenue on long-term contracts which the company estimates will bring in about $8.0 million annually. It closed a 25-year leasing and consultancy agreement in Washington State for its 10,000 sq ft facility back in October and at the beginning of January, Vodis announced that the tenant was ready to deliver its first crop for the recreational market. So unlike many others in the Canadian ‘dot-bong’ space, Vodis, through its publicly traded American subsidiary, is facilitating the production of actual product and getting paid for it.

Instead of sitting on its laurels now that the money is starting to roll in, Vodis is working on a smaller 2,000 sq ft facility for a tier 1 client as well as in the planning stages for another 10,000 sq ft tier 2 building where the company is interviewing candidate licensees – all of this servicing a regional recreational market that dwarfs the entire Canadian MMPR system. Vodis has a goal of not only building 100K sq ft of growing space in Washington, but it also has solid plans of expansion into other legalized states like Oregon and Colorado. Then you have California, with more people living in it than all of Canada, voting on legalization in November which many believe will pass. Did I talk about Europe?

I don’t think Vodis will have any trouble with these plans as they are knocking the socks off of American regulatory bodies with their exemplary building standards and they will are knocking the socks off of users with superior products in an inferior market. If 10k sq ft worth of growing space is going to bring in around $8.0 million, then just filling out Washington will bring in about $80.0 million for Vodis, can you imagine what the revenues will be post-expansion? Talk about an under-valued stock.

Now that doesn’t mean the company is folding up its Canadian operations for sunnier climes. Its application is still with Health Canada and Vodis has a fully completed warehouse in Delta which, with the flip of a switch, can go into operation on a moment’s notice. Even with the lights off locally, Vodis estimates that with what it has just today, it will be cash flow positive in 2016 – a claim that many other big Canadian licensed medical marijuana producers can’t make.

The legalization movement although still in its infancy, isn’t going away and right now is expected to generate $6.7 billion in 2016 in the US alone. With California, Hawaii, Missouri, Nevada, Arizona, Maine, Massachusetts, Rhode Island, Vermont, Ohio, Michigan and Connecticut all looking to legalize marijuana in some form, it is no surprise that industry experts expect legal marijuana revenues to hit $21.8 billion by 2020 – more revenue than the entire NFL generates. This is indeed a special time in the legal marijuana space as Good explained, “I’ve always looked at this as very similar to the end of prohibition in alcohol back in the 30s. There are going to be the same tremendous opportunities for the companies that get in early, do extremely well and get very big.”

Vodis is well on its way to establishing itself as one of these iconic companies.

So, now that I’ve had an in-depth look at both Vodis and BioMark, I can see their potential and the tremendous progress they’ve made, but does their leadership have the hutzpah to achieve their respective visions? Bill answered, “I’ve met with both of the management teams and they are hard-working and talented people committed to their cause. They don’t have time to play around and promote their stock, because they are on a mission 24/7 to take their companies to the next level. These are people of action and not words.”

I think smart investors would be well-advised to check out both Vodis and BioMark as potential additions to their portfolio, but this is my opinion. As always, do your due diligence before making any investment decision.

–Gaalen Engen

http://twitter.com/gaalenengen

FULL DISCLOSURE: Vodis Pharmaceuticals is a Stockhouse Publishing client.